Rent Vs. Buy

The choice between buying a home and renting one is among the biggest financial decisions that we make. Thanks to low interest rates and home prices that remain very reasonable, buying continues to look like a good deal in much of the country.

In the once-turbulent Phoenix market for example, the typical home price is still 30 to 40 percent below 2006 levels, even more if one accounts for inflation.

From 2004 to 2006, the math overwhelmingly favored renting rather than buying across most of the country. From 2009 to 2011, buying was an extraordinary deal in most of the country and even now.

Fueled further by the low-interest rate policies it seems that we are in the golden age of lending. Our current interest rates are aimed at bolstering the overall national economy and is a a great opportunity for home ownership.

Of course the wisdom of buying versus renting depends heavily on each person’s financial situation, plans and preferences. Home buyers in even the highest-price markets can take some solace in the fact that prices aren’t as outlandishly high relative to rents as they were in 2006.

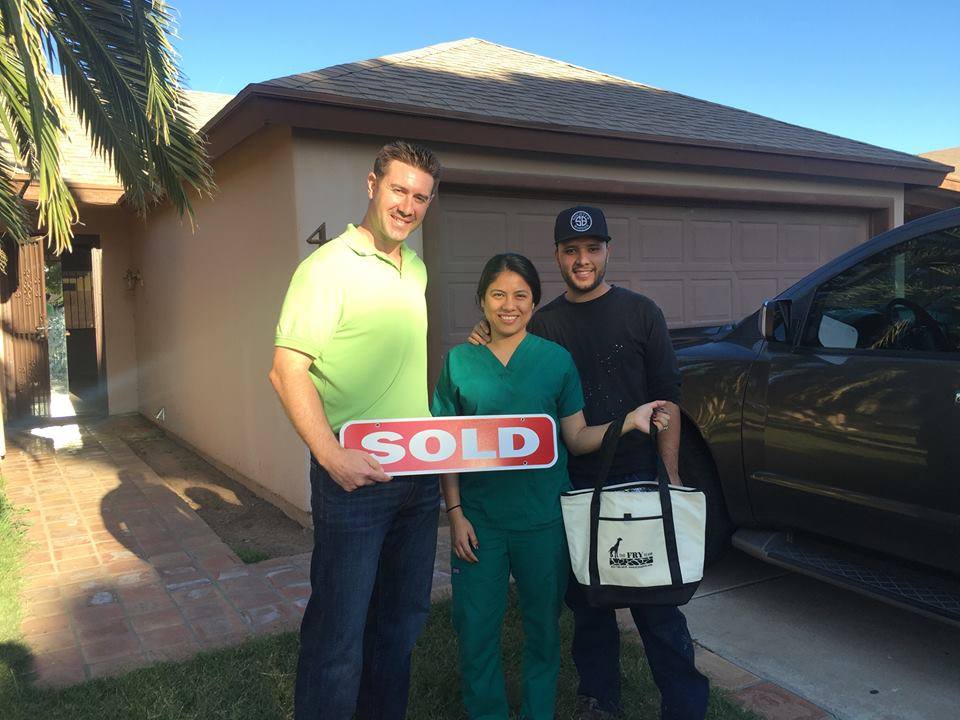

In fact, the Phoenix area is full of great deals to be had if one has the Realtor that knows where to look. In many cases mortgages are 25%-35% cheaper than rents.